Mastering the Art of the Family Budget

Raising a family can be expensive. Planning for your current and future needs often involves budgeting. But does the idea of setting a household budget sound intimidating? You’re not alone. Many people feel overwhelmed by the thought of organizing a family budget. Just remember, with the help of a budget, you will know where your money is going each month and you will have a spending plan that will help put your whole family on the path to financial success.

How Much Does It Cost to Raise a Family?

The costs that go into raising a family can add up quickly. According to the USDA, a middle-income, two-child, two-parent family spent around $12,980 annually (equivalent to $233,610 from birth to age 18) per child born in 2015.

Currently, the cost of raising a child has increased to about $17,000 per year (approximately $300,000 up to age 18).

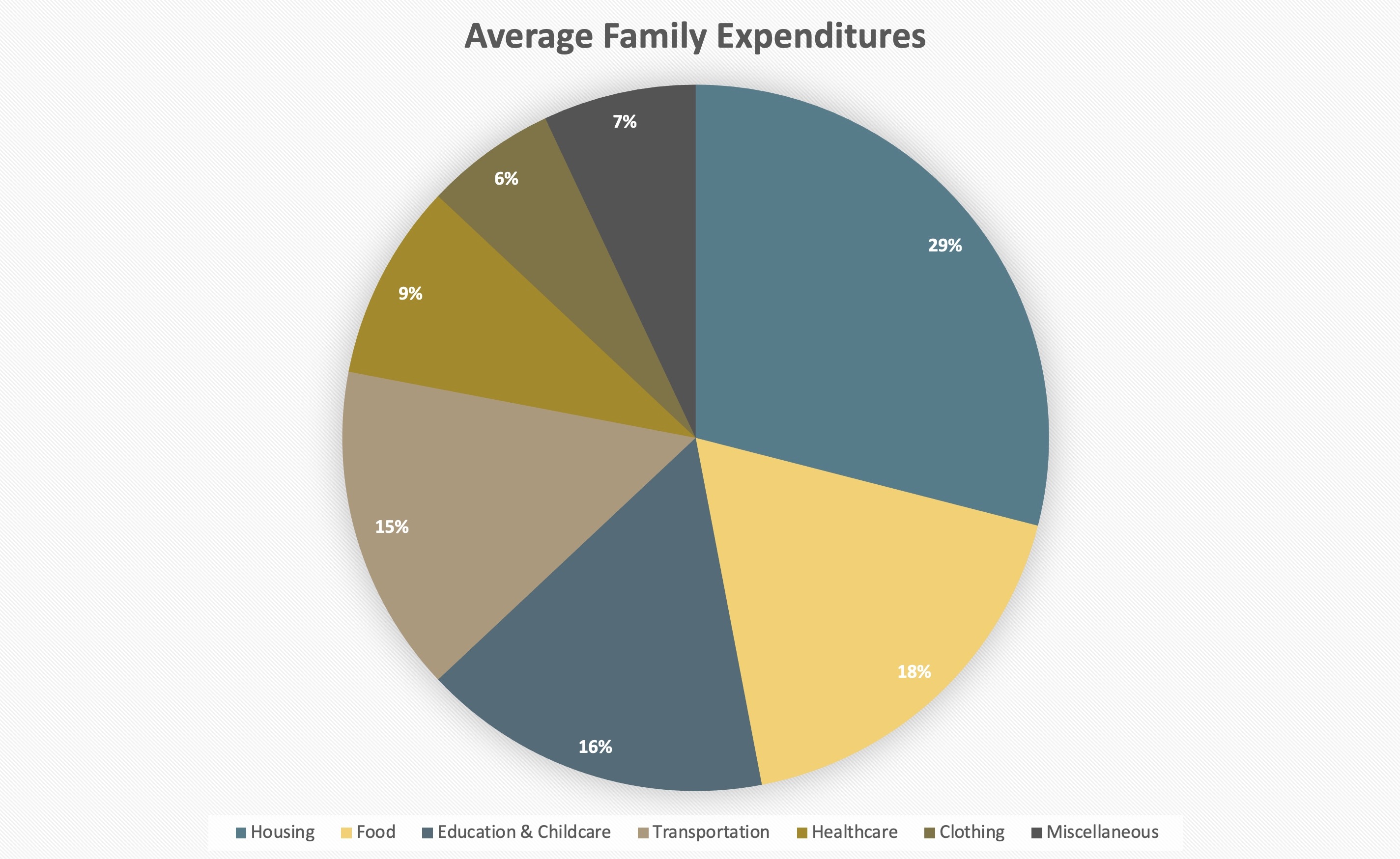

Of course, the cost of raising a family varies based on where you live and the number of children you have in your family. Here’s the typical breakdown of expenditures:

Creating a Family Budget

Knowing where your money is going can provide you and your partner with a sense of empowerment and give you a road map for your financial goals. Creating a family budget:

- Reveals wasteful spending. By identifying your budget busters, you may be able to reduce unnecessary spending.

- Provides direction for your future. A budget gives you a big picture view of your finances that can help you set clear priorities for spending and saving.

- Educates. Planning and following a budget can teach you and your family how to use money as a tool to achieve the things that are important to each of you.

- Creates healthy habits. By focusing on your priorities, you can avoid unnecessary spending, which can break old habits and form new, healthier ones.

Talking to Your Family About Budgeting

Almost half of all Americans say money is the most difficult thing to talk about. Although conversations about money can be stressful, having family conversations proactively may help everyone in your family work together toward healthy financial goals. Talking about money is important so you can:

- Teach children healthy financial habits. Children are listening to you, and when you set a good example with your finances, they will learn those skills as they get older.

- Be transparent about your household expenses. Your family may not know how much your housing costs, or how much you spend each month on utilities and other monthly household expenses. When you’re open about this information, it may give your family perspective on how much money is available for entertainment and extra purchases.

- Plan for the future. When talking about finances, you can also discuss savings goals like college tuition, and be proactive in planning for these future events with your family.

The Importance of Discussing Financial Habits

There will never be a perfect time to discuss budgeting with your family, but here are some tips on how to go about it and when to make opportunities.

- Talking to your partner. Even if one person takes the lead on day-to-day money management, it is important for both of you to be aware of key financial information in case of injury, illness, or incapacity. Schedule time together at least quarterly to talk about finances and find objective, tangible things like accounts and documents to guide conversations about money.

- Talking to your family. You may find it helpful to set a regular time to check in with your family about finances, whether it’s during dinner or when you are having family time together.

Embrace Budgeting for Family Success

While raising a family may come with its challenges, budgeting is a powerful tool to tackle those financial demands head-on. By creating a family budget, you gain control over your spending, make informed financial decisions, and pave the way for a prosperous future. If you have questions or need help managing your finances, reach out to your local Bank of Colorado branch.