Markets Fluctuate. Relationships Shouldn’t.

We want to help you stay proactive in this housing market. Purchase a new home before the end of June and if rates drop, we’ll refinance your loan to the lower rate AND waive processing and underwriting fees!

HERE'S HOW

- Start on your loan application now! Offer is valid for secondary market loans closed before December 31st, 2025

- If rates drop*, refinance your loan to the lower rate before December 31st, 2026 to have processing and underwriting fees waived!

REQUIREMENTS

- Loan must close with Bank of Colorado before December 31st, 2025.

- Borrower must make 6 payments - with no late or missed payments.

- Interest Rates must decrease by at least .50%.

- Refinance must close before December 31st, 2026.

*Interest rate on refinance must reduce interest rate by a minimum of .50% from original loan rate and must have a net tangible benefit. Conditions and restrictions apply. Not all applicants will qualify. Loan approval is subject to final underwriting review and approval. Contact your loan officer for more information. Offer only eligible for secondary market loans.

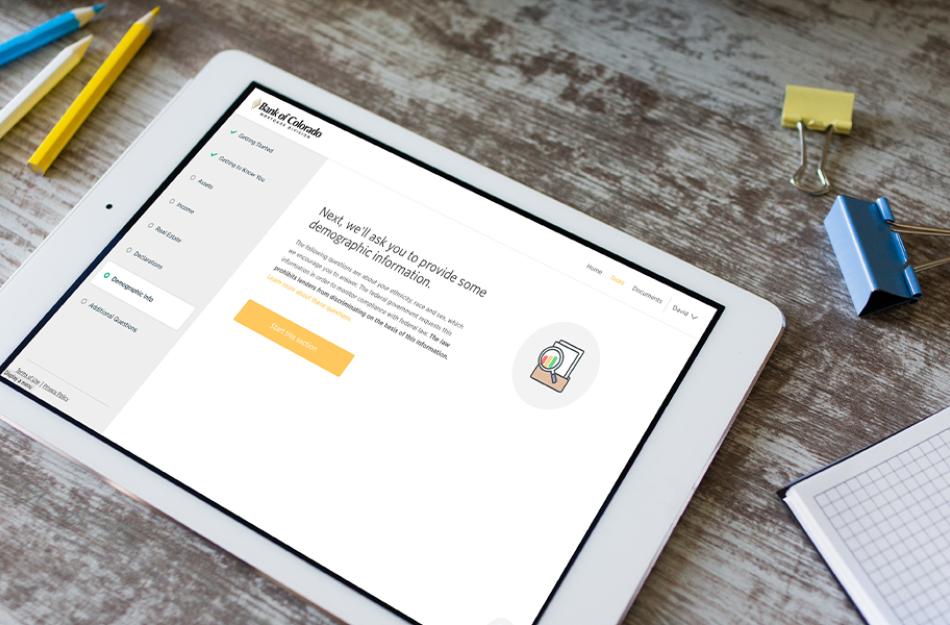

Personalized, Online Mortgage Applications Made Easy

Take away the pressure of completing a mortgage application by visiting one of our branches or using our easy Mortgage Portal platform.

Start Your Application

Check Out Our Destination Home Program

There's only one dream like owning a home. But the road there can be difficult. Our Destination Home Program offers a variety of loans to make that dream a reality, for all Coloradans.

Get The Details

Your Loan Officer Will Help You Find Affordable Rates

Don't worry about looking up interest rates. We'll personally help you find the best possible rates and payment options available.

Find a Mortgage Expert

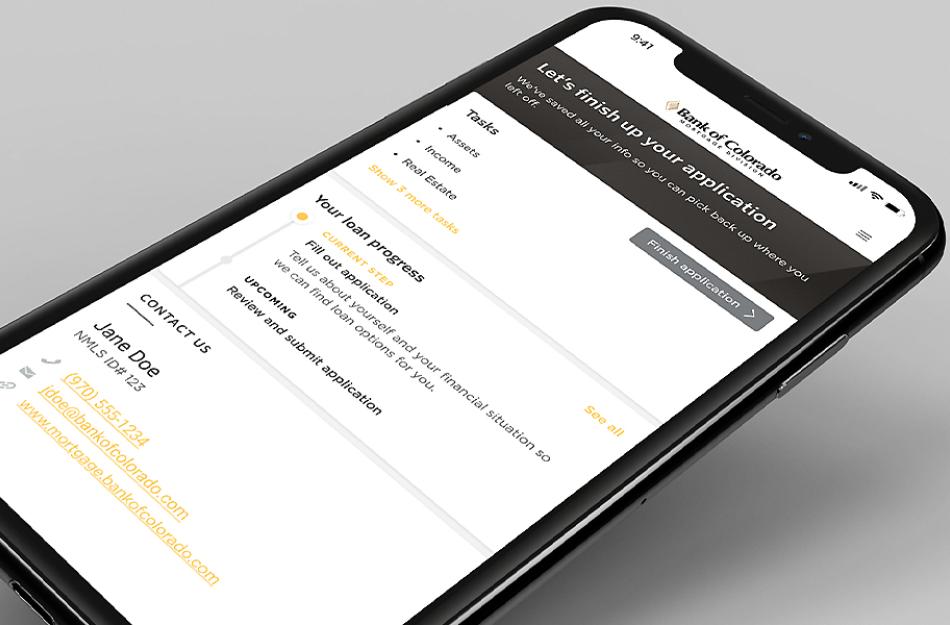

Track and Complete Your Application From Anywhere

Our Mortgage Portal is all about easy, convenient access, on mobile, desktop, and right at home. Complete your application whenever you're ready by tracking your progress or setting up reminders so you don't forget.

Avoid Unwanted Calls Before You Apply

Anytime your credit is pulled when applying for a loan, credit bureaus can sell your contact information, leading to unwanted spam calls, texts and emails. Save time by adding yourself to the Opt Out Prescreen Registry today!