What is a Credit Score

A credit score is a numerical ranking of your credit worthiness. It is based on your credit and spending history. A credit score helps lenders make decisions on whether to offer you a credit card, auto loan, home loan and other credit products.

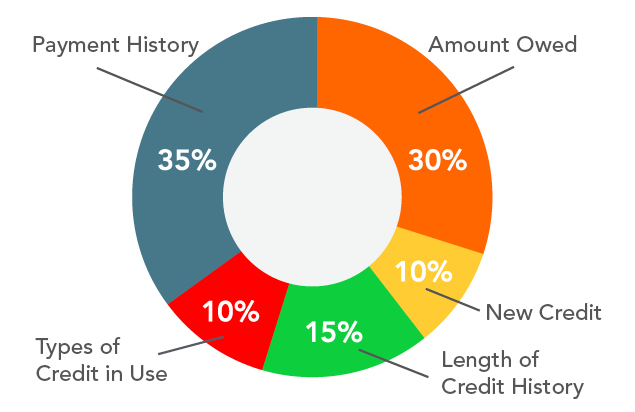

Anatomy of a Credit Score

How your credit score is made up.

35% Payment History

Do you pay your credit on time?

TIP: Set your bills on automatic payment so they are paid on time.

30% Amount Owed

How much of your credit limit are you using?

TIP: Do not exceed your credit limit. If your credit limit is $1,000, keep the balance well below $1,000.

15% Length of Credit History

The longer the credit history, the better.

TIP: Longer credit histories give lenders more information on how you handle debt.

10% New Credit

Within the past 12-18 months, how many times have you applied for new credit accounts such as loans or credit cards?

TIP: Only apply for credit when essential. Don’t hesitate to decline credit card offers, regardless of store discounts or offers.

10% Types of Credit in Use

What are your accounts made up of?

TIP: A healthy mix is made up of a few types of credit accounts such as a car loan, credit card, and line of credit.

Evaluating Credit Using the 5 C's

What does your credit history look like?

Is there enough income to support your debts and obligations?

Do you have savings or assets to prevent default?

What is the value of the collateral?

What are the loan specifics such as interest rate, maturity, and repayment terms.

Evaluating Credit Using the 5 C's

Frequently Asked Questions

You've got questions, we've got answers.

How do I build my credit score?

Talk to your local lender; they may have solutions depending on your situation.

How do I dispute something on my credit report?

Contact the credit reporting agency and the debtor, you must be able to provide your security information.

How do I maintain a good credit score?

Only apply for credit when you need it. Pay your loans and/or bills on time. Always keep your balance under your credit limit.

If I co-sign on a loan, does it report on my credit?

Yes, it will show up on your credit report. Their debt is your debit, late payments will count against you.

Who are the credit reporting agencies and how can I reach them?

Equifax

1-888-378-4329

Equifax.com

Experian

1-800-397-3742

Experian.com

TransUnion

1-800-916-8800

Transunion.com

Who uses a credit score?

- Lenders

- Landlords

- Potential Employers

- Leasing Companies

- Utility Companies

- Insurance Companies

Why are credit scores important?

- Consumers who have a higher credit score generally get better credit terms.

- Having a good credit score may get you discounts on your insurance.

- You may have an easier time renting or buying a home.

Start Living Your Life, Diamond Secure

There's plenty that comes with a Diamond Secure Checking Account, including free credit monitoring service, a Visa Debit Card, free online and mobile banking, and no minimum balance.